Quoting Experience Modernization — mobile-first, faster, clearer

I didn’t redraw screens; I redesigned momentum—fewer decisions, faster signals, and recovery that earns trust.

Snapshot

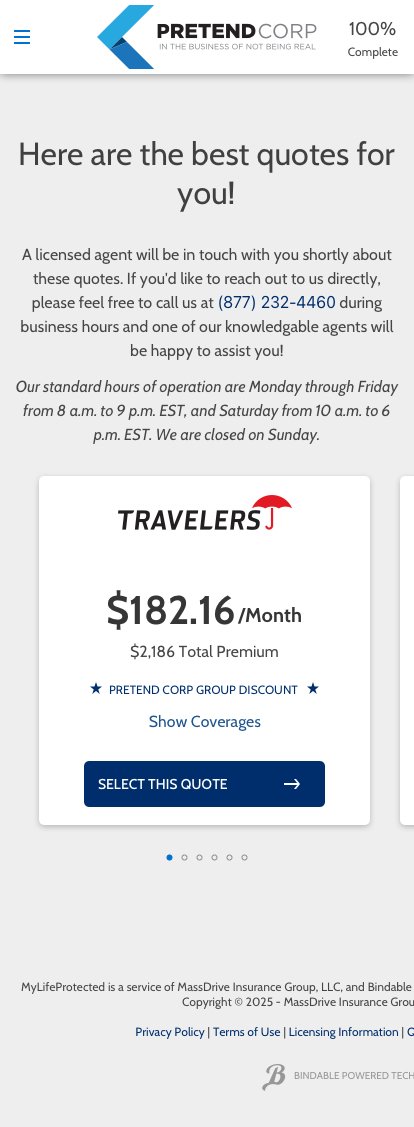

Start-to-quote conversion:

~75% Auto Insurance

~85% Home Insurance

Form quality:

Inline validation + clearer error recovery, 3rd party data availability

Design system:

Pattern library rolled into the tokenized design system

Speed feel:

Loading/polling + optimistic UI reduced perceived wait time

Project summary

Observation:

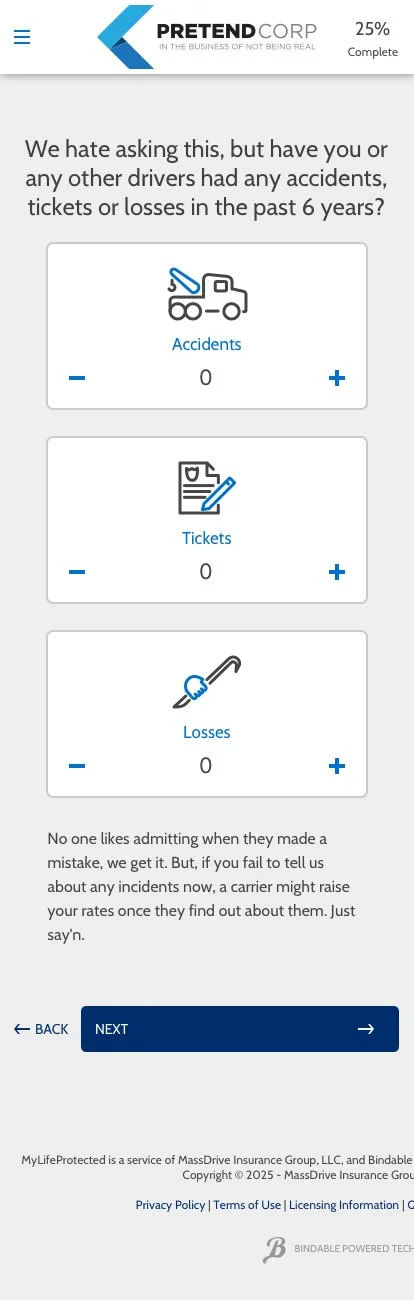

Consumers abandoned early: click-heavy steps, dense forms, and little feedback on mobile.

Insight:

Users responded better to smaller, clearer steps—they cared less about the number of steps than about how hard each one felt.

Intervention:

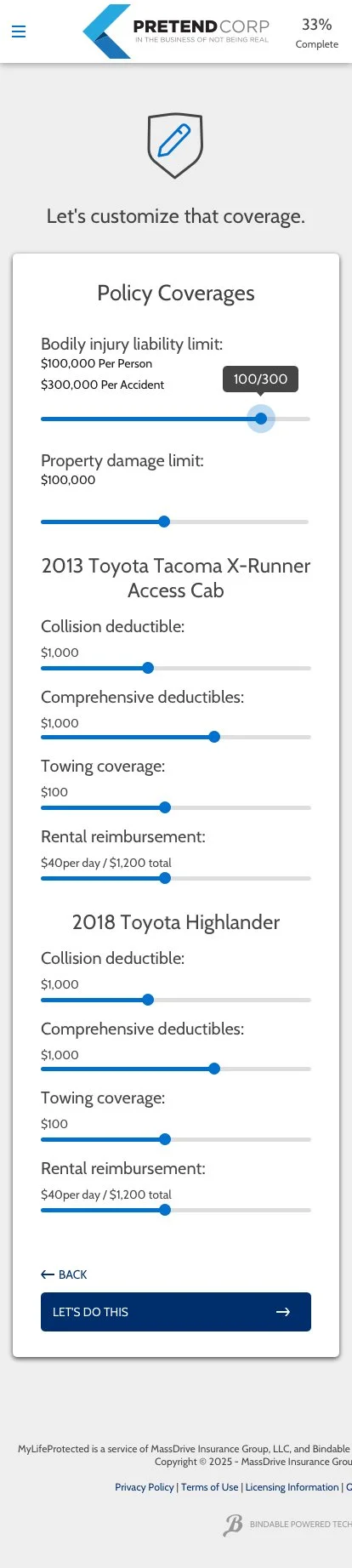

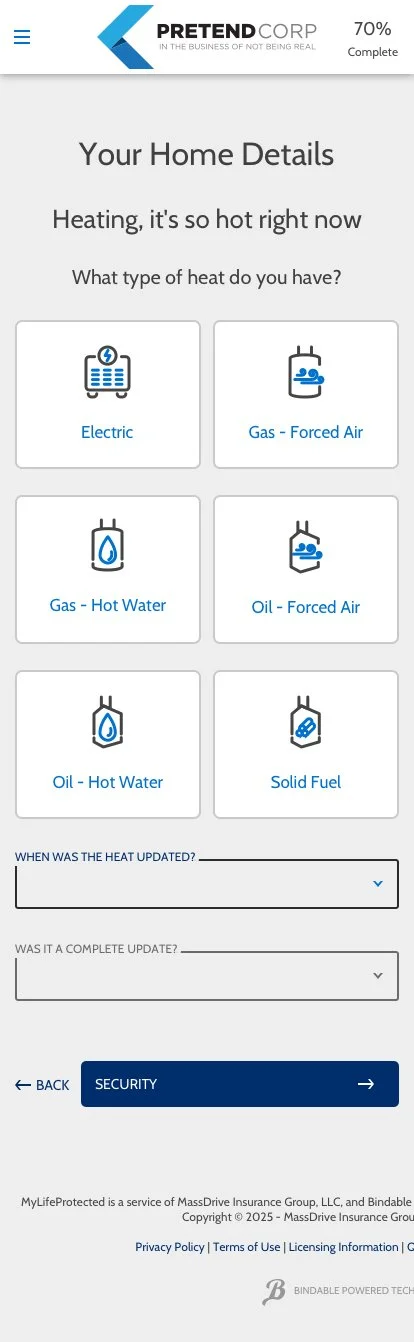

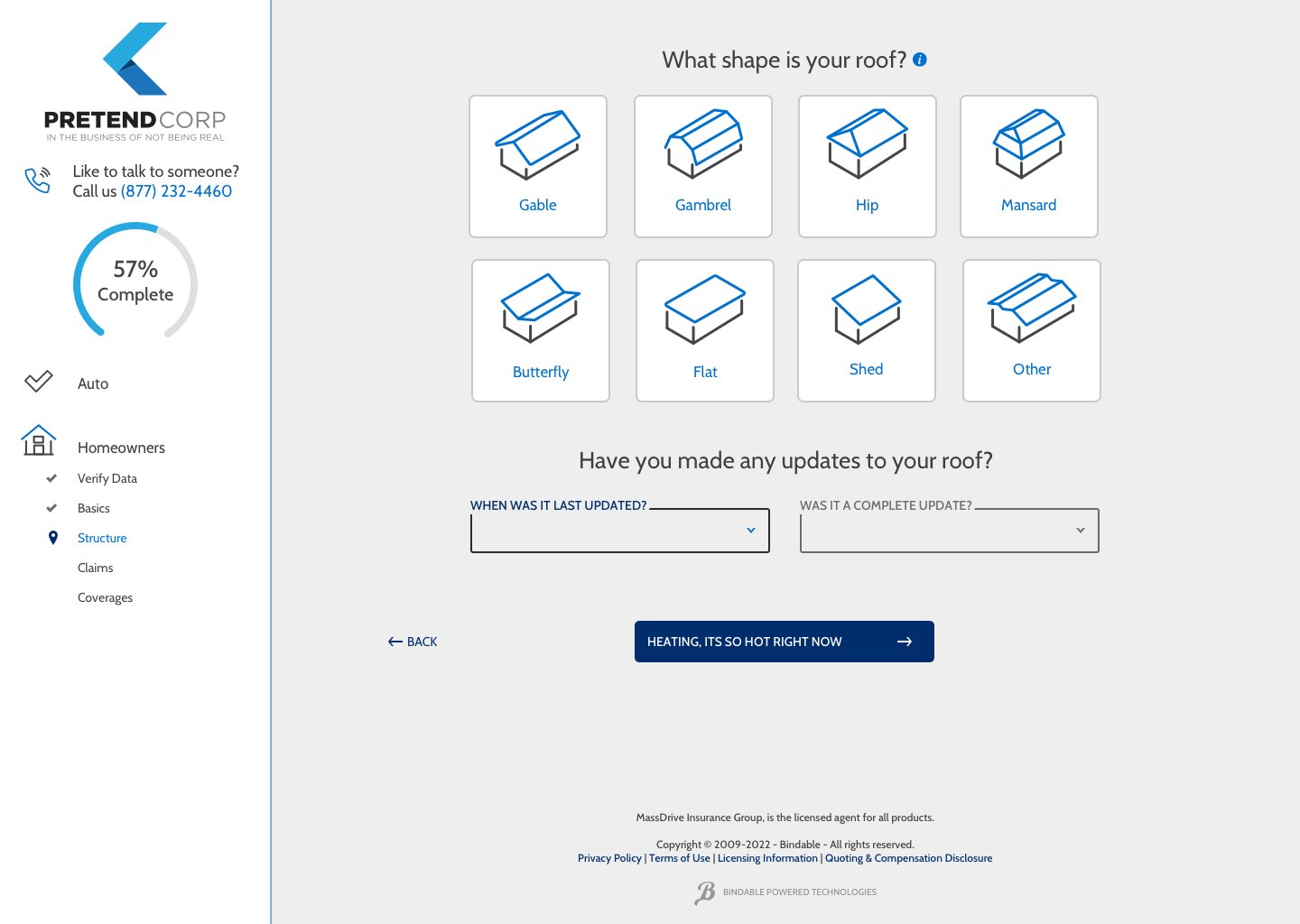

Broke large pages into smaller steps.

Optimistic UI reflects actions instantly while background work completes (with safe rollback).

Codified these patterns in the design system for reuse.

Impact:

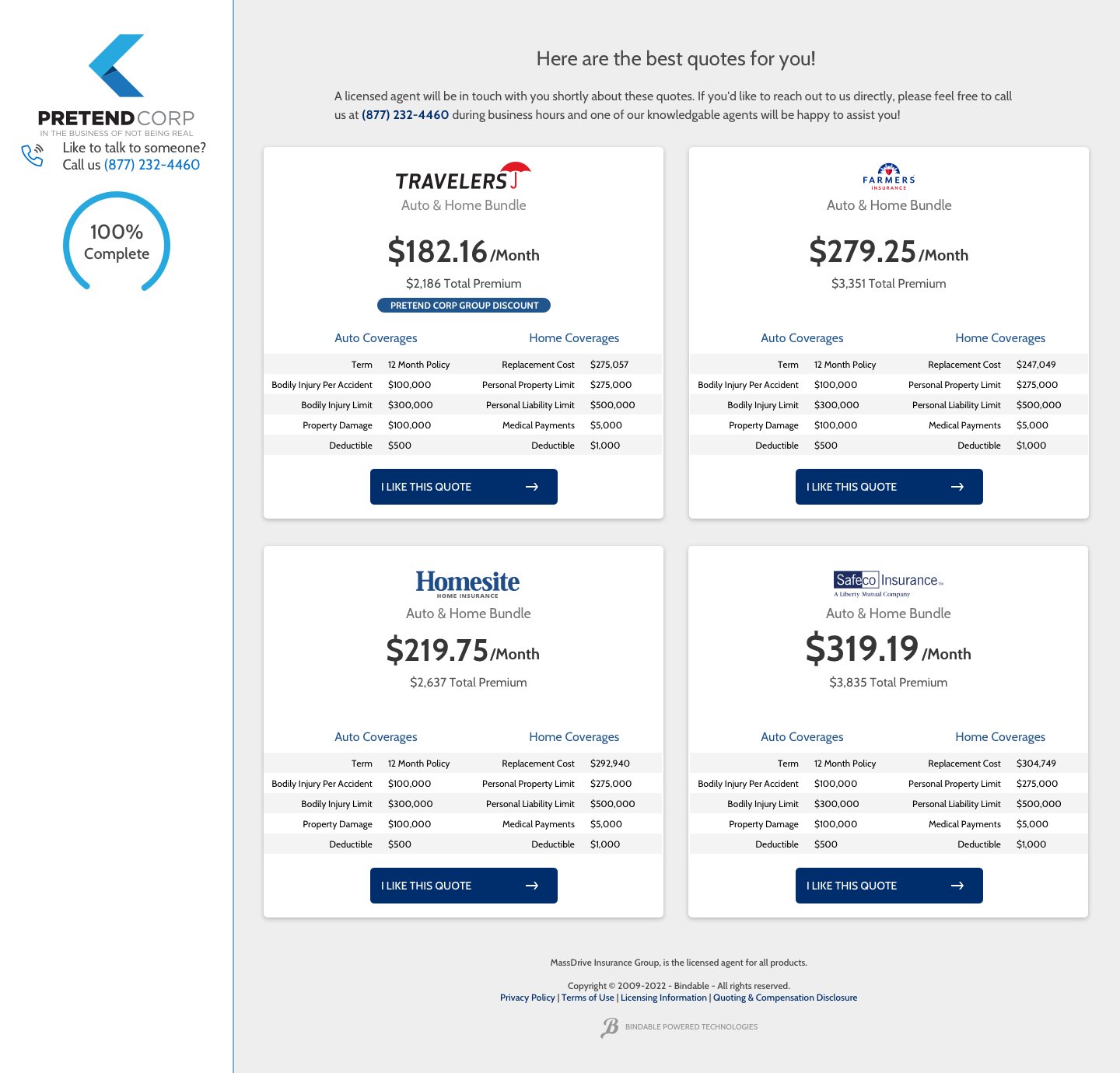

Start-to-quote ~mid-70s (auto) / ~mid-80s (home); cleaner data capture; fewer error-abandon events; the flow feels simpler while capturing the same data set.

Experience highlights

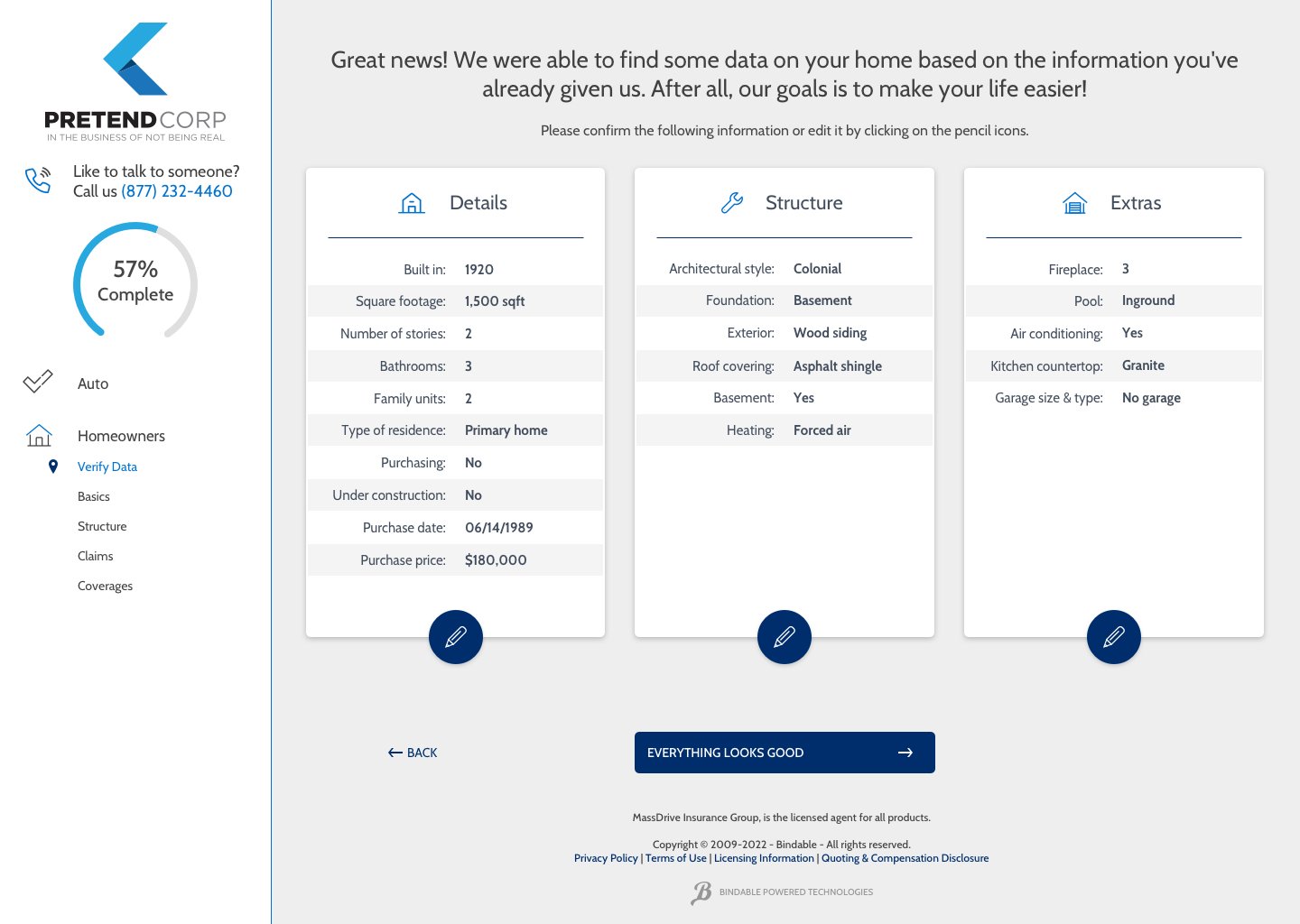

Agent interface modernization: Mobile-first layouts, progressive disclosure, inline validation, and a micro-interaction layer to reduce friction.

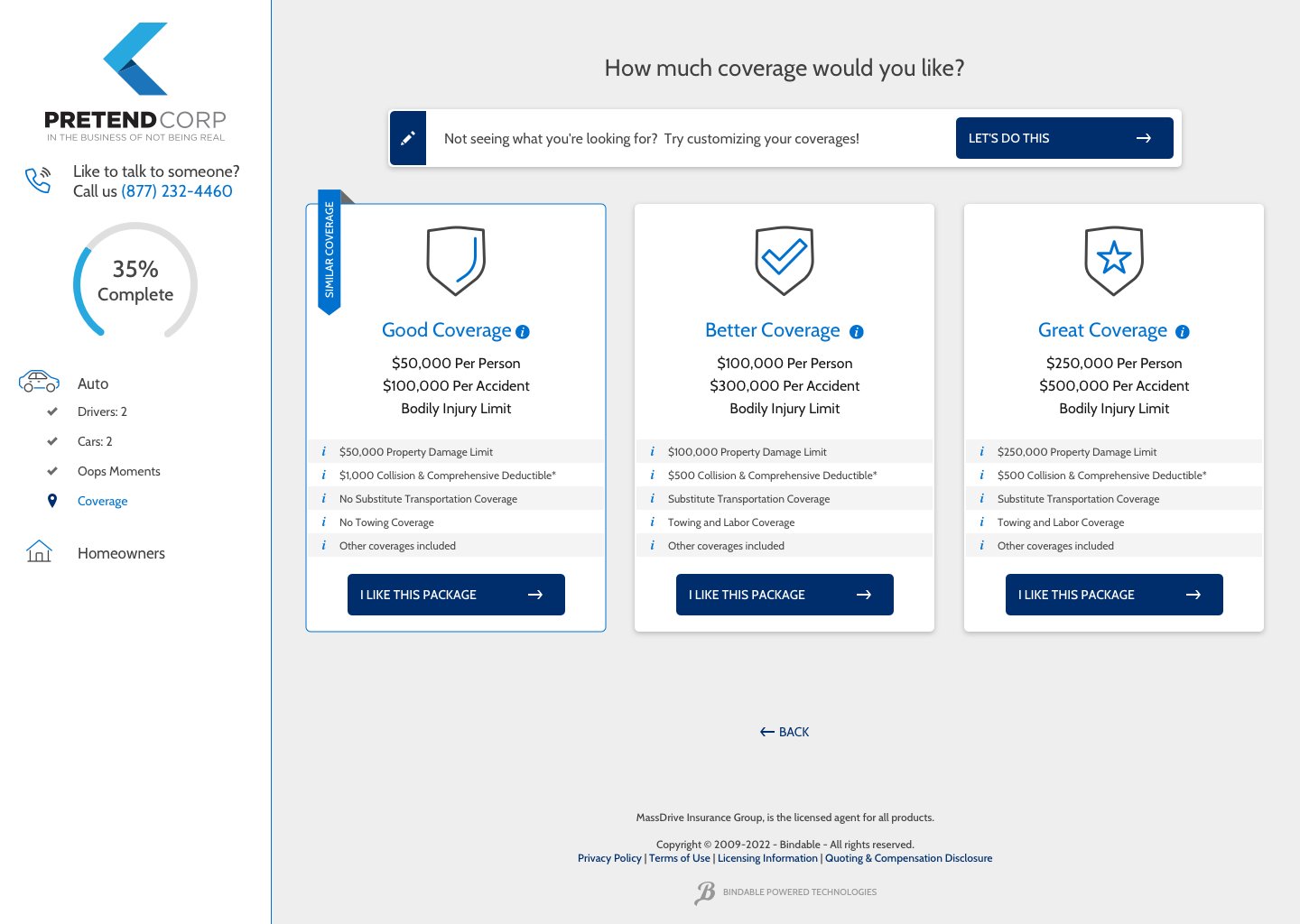

First-of-its-kind bundling: Single-form auto + home quoting—unified data entry and pricing logic to eliminate duplicates and speed submissions.

Design system: Tokenized components + docs + governance → reuse ↑, defects ↓, delivery faster.

UX research: Hotjar user recordings, prototype/usability tests, analytics reviews; insights captured in decision memos that shaped roadmap bets.

Contact strategy: Coordinated SMS/email/phone journeys mapped to funnel events with compliant timing and easy opt-outs.

Role: Head of Product Design

End-to-end flow, interaction patterns, systemization.

Collaborators:

PM, Eng, QA, Call-center Ops (contact journey), Data/Analytics (funnels, test design).

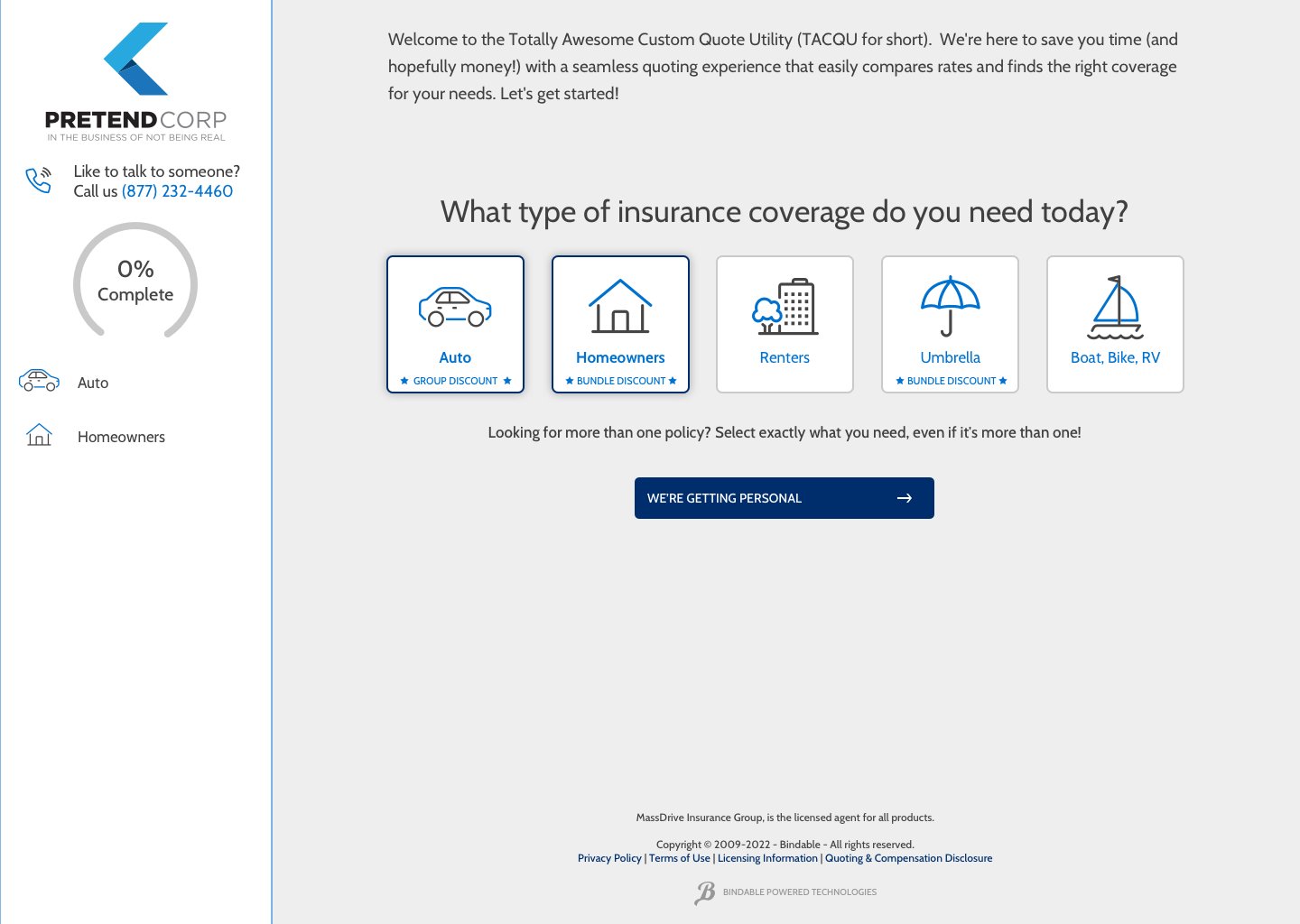

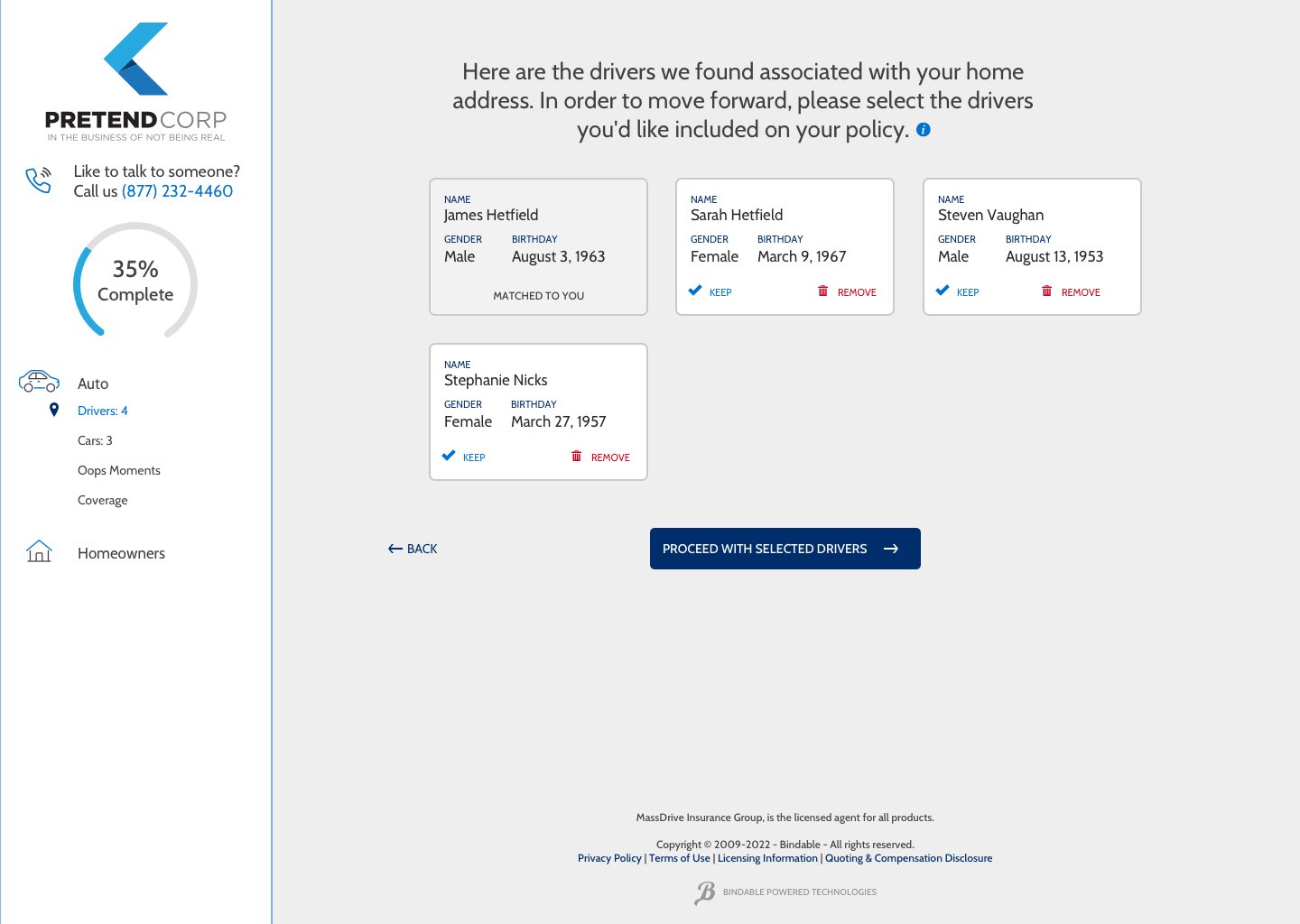

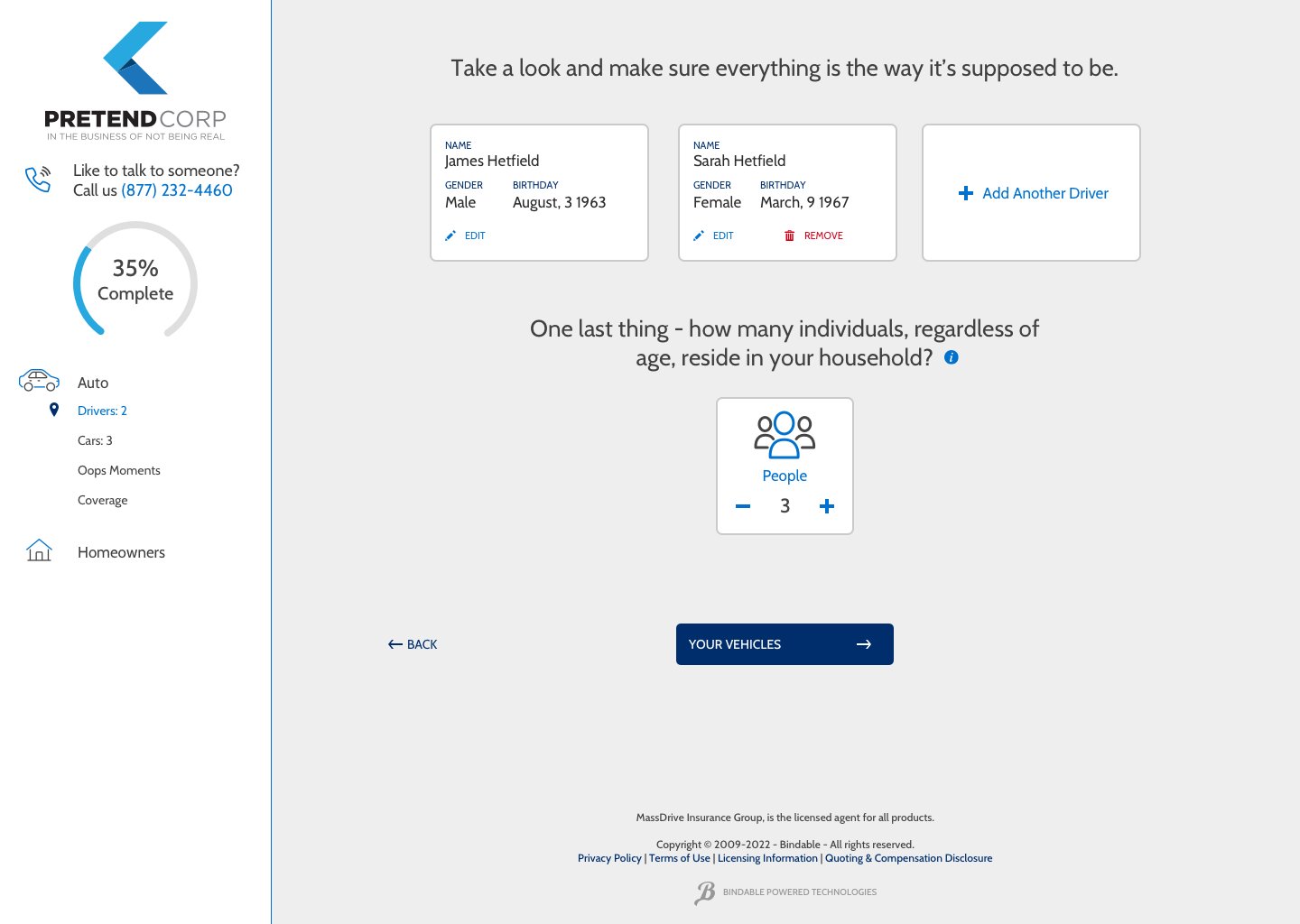

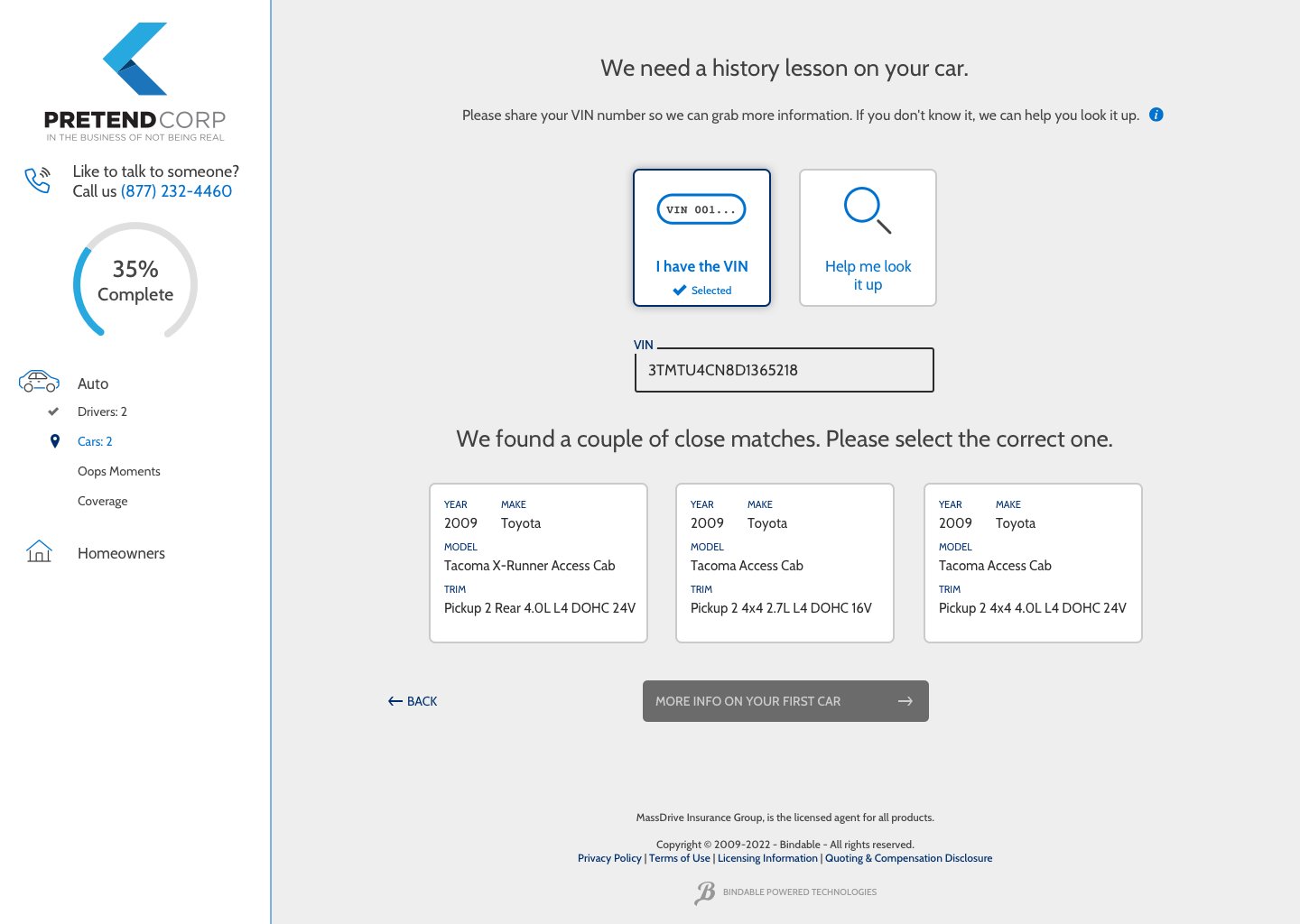

Quoting experience design before reimagining.

Screens