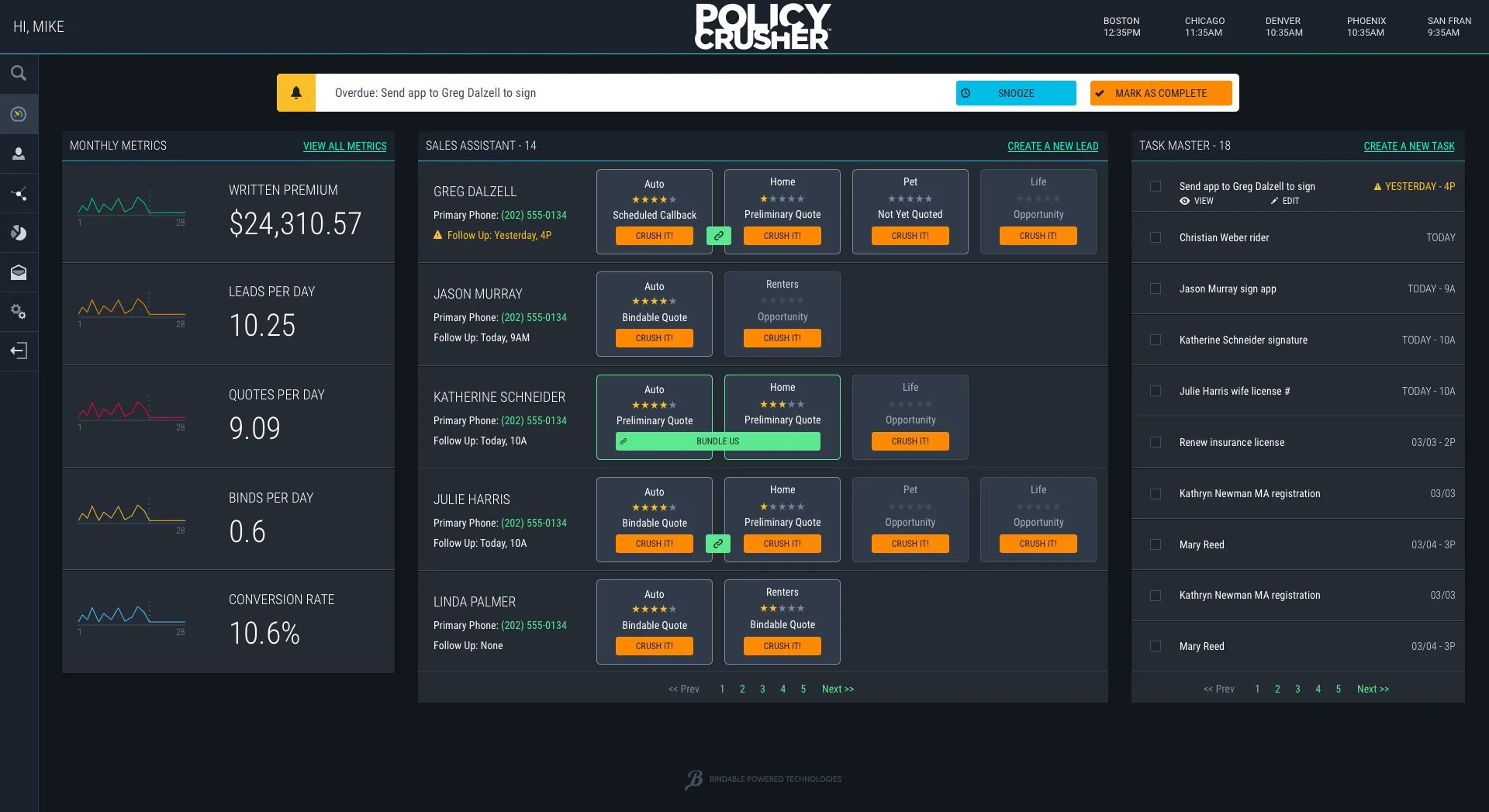

Policy Crusher® — modern agent software for quoting, cross-sell, and CRM

Watching agents quote customers, I saw the same friction points repeat—too many clicks, complicated forms, and little to no UI feedback. My goal wasn’t to redesign the screens; it was to design a smoother way to work.

Project Summary

Observation:

Click-heavy steps, dense forms, and silent waits created hesitation.

Insight:

The problem wasn’t effort—it was confidence. We needed fewer decisions per step and timely feedback to keep momentum.

Impact:

Enterprise SaaS platform that now quotes ~$16B in premium annually; cleaner agent workflows; one agent called the software “a delight to use.”

Intervention:

Design the seams: progressive disclosure to trim inputs, inline validation to prevent errors, optimistic UI with background polling and safe rollback, and recovery paths that never dead-end.

Role: Head of Product Design

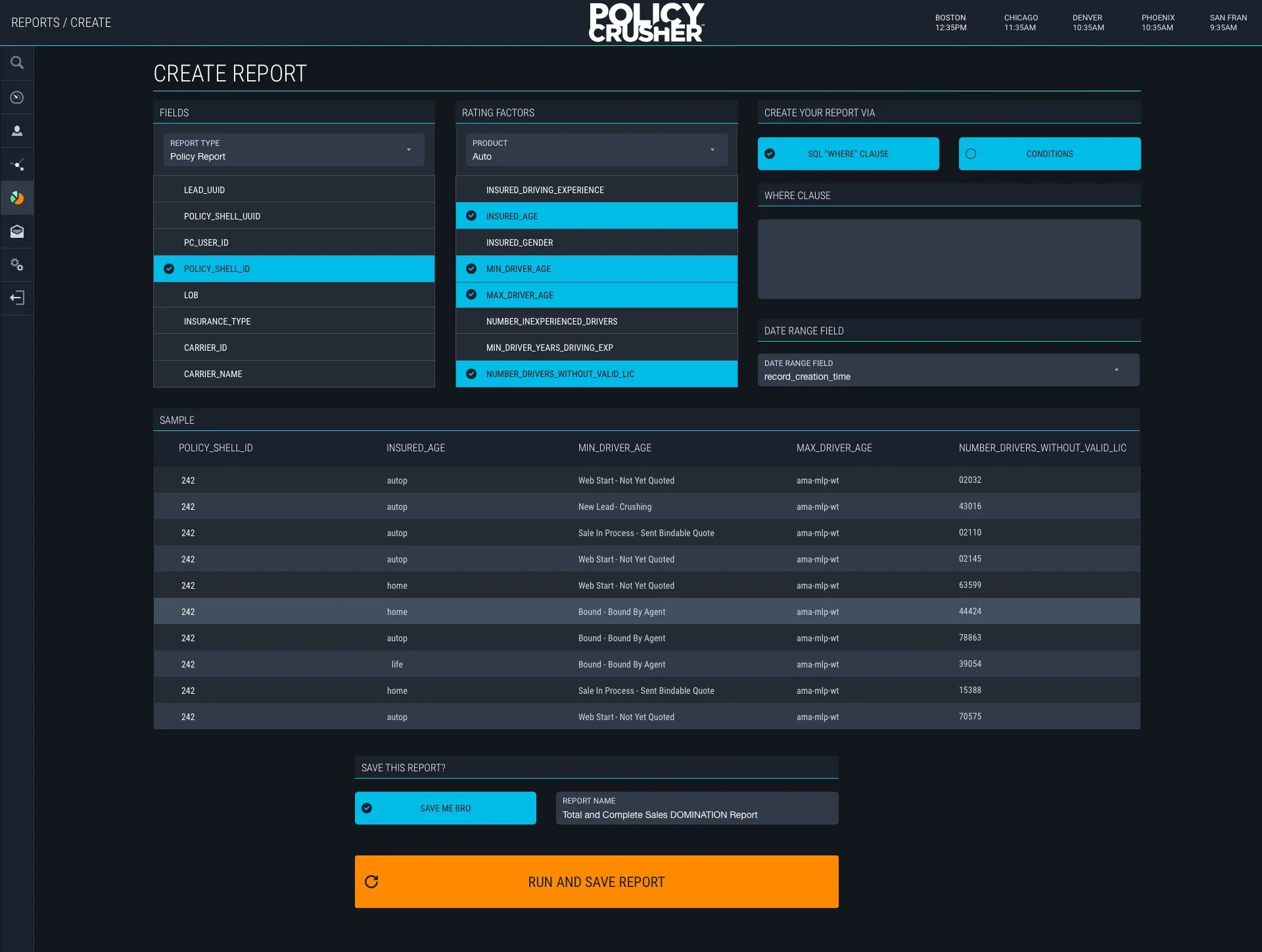

Scope: discovery, IA, flows, interaction design, prototyping, analytics instrumentation, experimentation cadence, front-end development, UX research, design system governance.

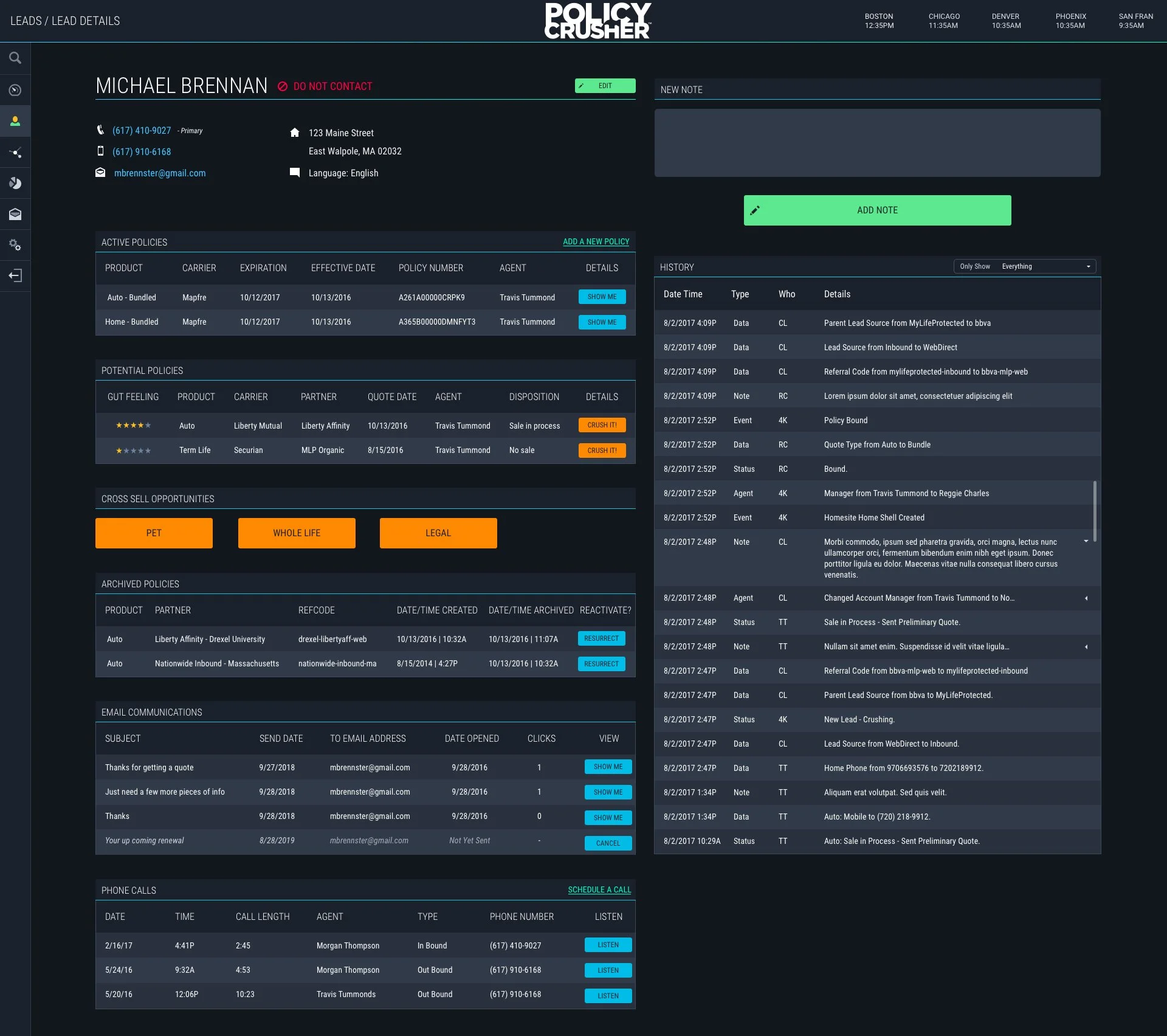

Experience highlights

Agent interface modernization: Progressive disclosure, inline validation, and a rich micro-interaction layer (loading/polling, optimistic UI, cart pattern) to reduce perceived latency and friction.

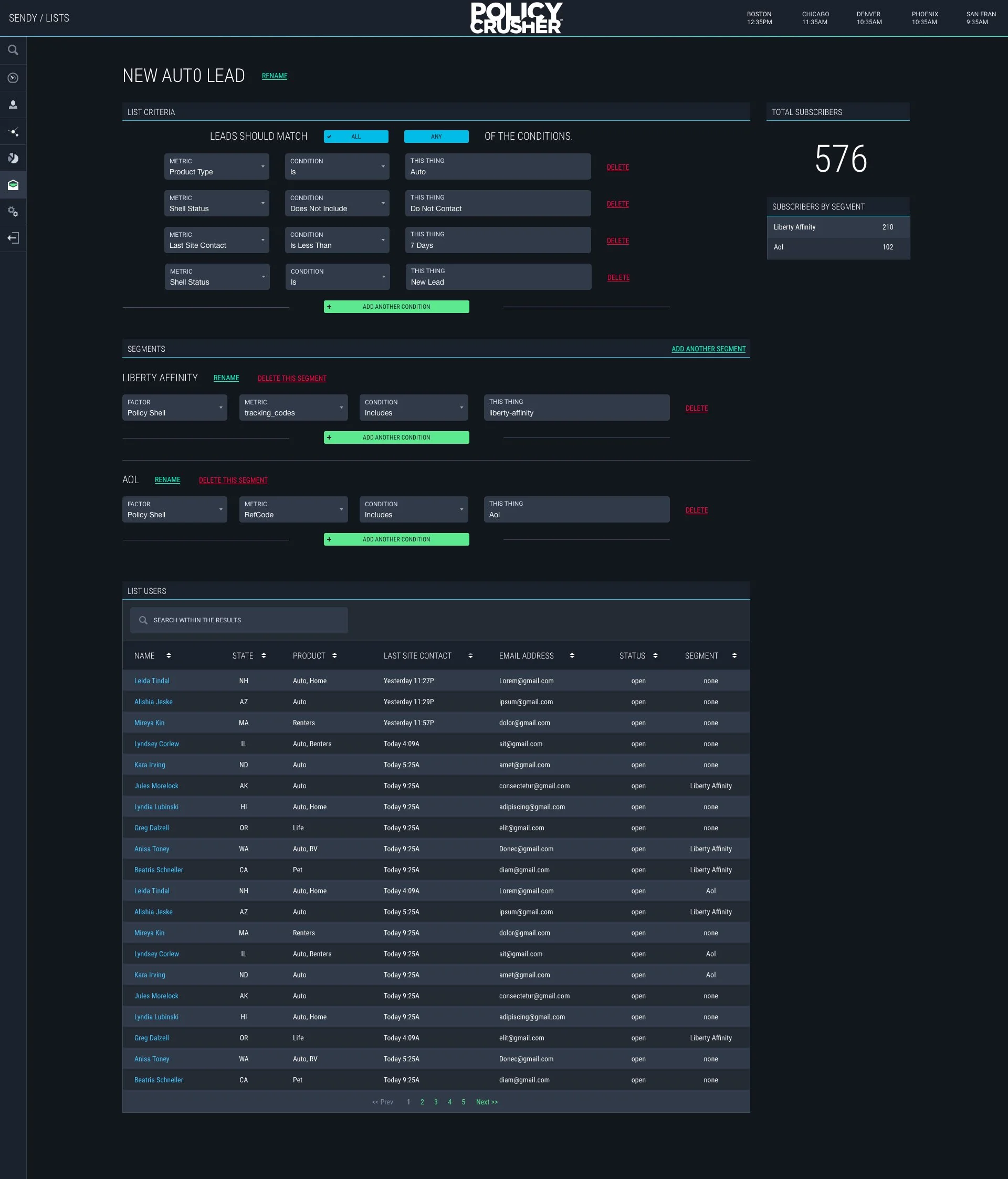

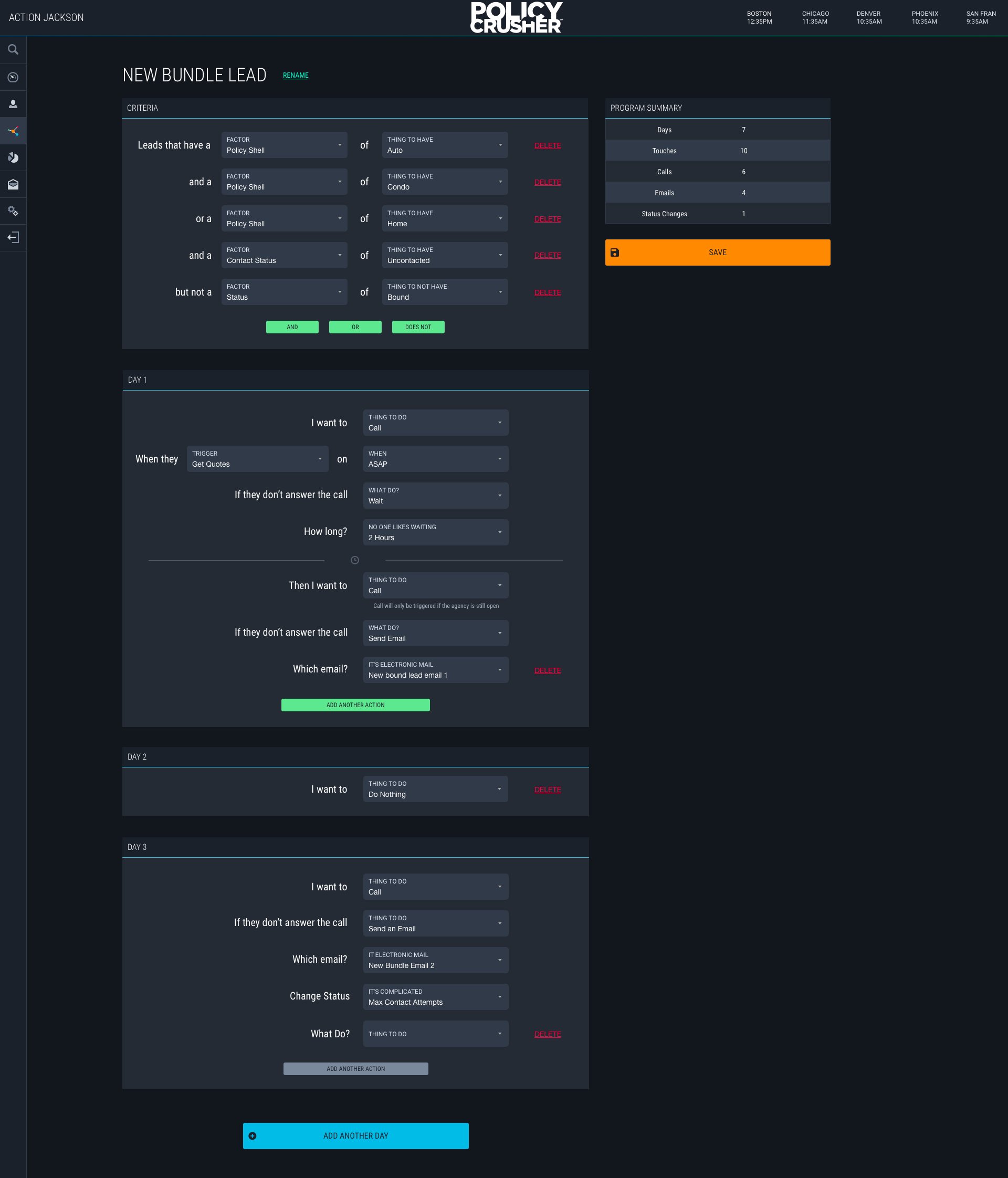

First-of-its-kind bundling: Single-form auto + home bundle quoting for agents—unified data entry and pricing logic to eliminate duplicate fields, streamline cross-sell, and speed bind-ready submissions.

Design system: Tokenized components + docs → reuse up, defects down, delivery faster across pods and co-branded sites.

UX research: Discovery interviews, prototype/usability tests, and analytics reviews synthesized into decision memos; steady cadence of insights driving roadmap bets.

Contact strategy: Coordinated SMS, email, and phone journeys with compliant timing and opt-outs.